So Zero Hedge posted this incredible chart showing that the US dollar has lost 94% of its value over the past 76 years.

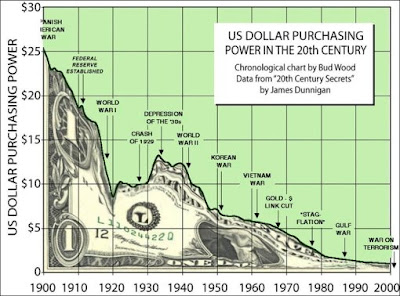

Here’s another chart, this time starting from 1900 instead of 1929. The decline has been even steeper if you change the starting period to 1900.

Hmm..The dollar has declined 40% in the last 25 years(since 1985), and 80% since 1970! While the decline may seem even steeper since 1900, on an annualized basis it's a little less than if you were to start from 1933. The declines have been of the order of 3% since 1900, 3.6% since 1933, and 4.4% since 1971. So has this been the story throughout history? Apparently not, as this chart going right back to 1800 demonstrates.

These charts really put the current debate on fiat money in perspective. Blaming the current policies is easy, but the truth is that this decline has been the historical story for the past 100 years. The charts above would hold true for most of the world's currencies. According to dollardaze.org, the best performing currency in the 20th century was the Swiss Franc, losing only 80% of it's value(!). While currencies may go up and down, the long term trend for any fiat currency has been down since the beginning of the 20th century.

I would also argue that this isn’t necessarily a bad thing. The 20th century has arguably been the most prosperous century in human history. While dollar’s purchasing power has indeed declined, the average living standards today are a lot higher than they were even a few decades ago. A little bit of inflation can be a good thing.

UPDATE: This post was updated on 5/11/2009 at 10.21 pm.

1 comments:

While standards of living have certainly increased, I wouldn't jump to the conclusion that inflation caused it. I would be more inclined to assert that standards of living increased in spite of inflation.

Post a Comment